2008 Was An Appetizer

The American national debt is now over $18 trillion dollars. The housing crash and resulting crisis of 2008 was just a preamble to the chaos that will ensure when the government can no longer pay its bills. It's not "if," but "when" it will crash. According to Peter Schiff, the economist who predicted the 2008 housing crash, the "Real Crash" is coming. Let’s take a look at some reasons why, and what you need to know.

Some Not-So-Fun Facts

The "budget deficit" figure, which gets the most press coverage, is merely the government’s shortfall between revenue and expenses for one year. The national debt is the accumulated deficits from all previous years. Plus interest.

How big is $18 trillion? There are many "If the debt would be stacked in dollar bills, they would reach to the moon five times" fun facts. But $18 trillion is not funny, and any cute description or answer of what it "really is" falls far short of the catastrophic implications.

Here is the simplest answer: $18 trillion is more debt than we can afford to pay off. Ever.

Mandatory federal spending surpassed total federal revenue for the first time in 2011. That means that paying for essential services like the armed forces, social security, Medicare, and of course the interest on the national debt, cost more than the tax revenue brought in that year. We now have to borrow just to pay our soldiers, care for our elderly, and pay interest on the money we borrowed the prior year. Talk about robbing Peter to pay Paul.

“No tax hike or budget cut can fix a problem this large. The necessary fiscal and monetary policy changes that might delay or soften the financial crisis are seen as too severe. Elected officials who want to keep their jobs will not vote for them.”

Finger Pointing Time

How did the U.S. get here? The world's biggest creditor at the end of World War II now turns into the world's largest debtor in just 60 years? While dozens of causes could be covered, there are two somewhat-agreed-upon influencing factors.

1) The Federal Reserve The "Fed" is a private bank formed in 1913. It was tasked by Washington to take over the money supply and central banking functions. It has since become the main force in interest rate manipulation, as well as the main purchaser of US treasury securities sold. (In other words: it buys the US debt and charges the government interest for doing so.) Interesting that the same bank does both functions, isn't it? Oh, and the dollar has devalued by 95% since the fed took over the money printing role from the government.

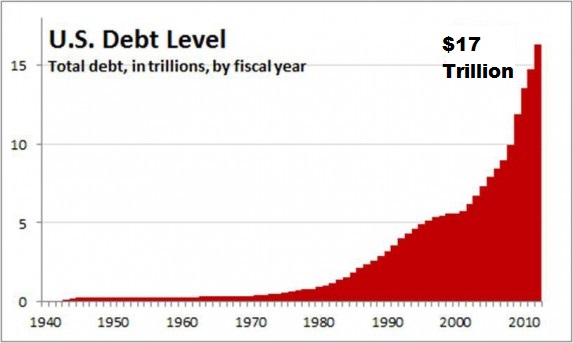

2) The Gold Standard In 1971, President Nixon took the United States off the gold standard", meaning the amount of money in circulation was no longer tied to US gold reserves on hand to back the currency. It became a license to print. And the Fed did. In almost 200 years between 1776 and 1974, the US had accumulated a total outstanding debt of just $484 billion. Since then it has grown exponentially to $17 trillion. Coincidence? Doubtful.

It Only Gets Better

Want more bad news? Do the math like David Walker did last year. Walker was the United States Comptroller General from 1998 to 2008. He knows how to do some scary addition. He took the $18 trillion debt, then he added current unfunded but "mandatory" expenditures (such as social security) and then he also included future “promises-to-pay” (such as the future interest on our debt). So, what was his result? He concluded that the outstanding liabilities of the US government totaled $70 trillion. Not $18 trillion. $70 trillion. He was using generally accepted business accounting principles to arrive at this $70 trillion figure. The federal government does not follow generally accepted accounting principles. For 70,000,000,000,000 obvious reasons.

Madoff Was Nothin’

How, then, have we been paying the interest on current debt and the mandatory expenses when we don't take in enough revenue? Simple. We borrow more. It's the greatest Ponzi Scheme of all time. Just as these schemes collapse when new investors stop contributing new money to pay off the prior investors, the US economy will collapse when other outside countries stop buying our future debt to pay off the treasury notes that are coming due now.

What's Next?

As mentioned above, economic collapse is inevitable. It will happen one of two ways, as has happened to numerous governments in the past, ever since the Greek sovereign default, 400 BC, or the Roman inflationary crisis, 241-146 BC.

1) The Federal Government defaults on its debt The resulting economic fallout will be severe. Credit as we currently know it will disappear. Payments to critical government services will stop or be severely slashed. Unemployment will skyrocket. There may be riots in the streets. We’ll have to actually spend less than we make. While this pill is the most bitter to swallow, it is also the most effective. , Yet, a debt default is not likely. Why? They are the Government. They’re expected to do something, right? So...

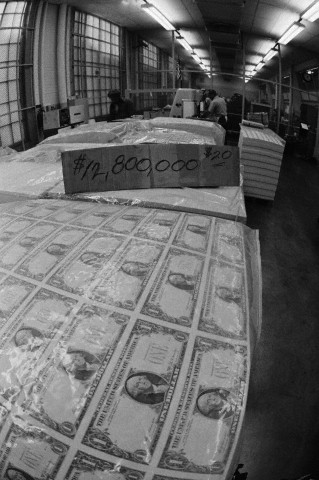

2) The government will try to "print" its way out of the cash shortage The Fed will create trillions of dollars in paper bills out of thin air. These dollars will be used to pay back the debt, but will also lead to hyperinflation as the same goods and services will cost many times more since the money supply will have become increasingly worthless. Historically, the unemployment, poverty, and recovery time will be even worse than in the first scenario.

What Do You Do?

The United States has been through eighteen financial crises since 1776, but never a complete default. During these events, some people lost everything: wealth, jobs, health, even life. The good news is, there is still time for you to prepare for what’s up ahead and be as financially safe as possible.

Whether you are wealthy or bankrupt, whether you live in a mansion or a studio apartment, no matter what your current situation may be, knowing what’s coming is your first step in being prepared.

Once you see the writing on the wall, having a “Plan B” is your next step. This will be the focus of an upcoming post. Until then, consider yourself informed…